First REIT

Sponsor and largest unitholder of First Real Estate Investment Trust (“First REIT”), Singapore’s first healthcare real estate investment trust listed on the Main Board of the SGX-ST

First REIT was established with the principal investment strategy of investing in a diversified portfolio of income-producing real estate and/or real estate-related assets in Asia that are primarily used for healthcare and/or healthcare-related purposes.

OUEH and OUE Limited hold a 40% and 60% stake in First REIT Management Limited respectively, the manager of First REIT. OUEH is also First REIT’s sponsor and largest unitholder, holding approximately 33% of its units.

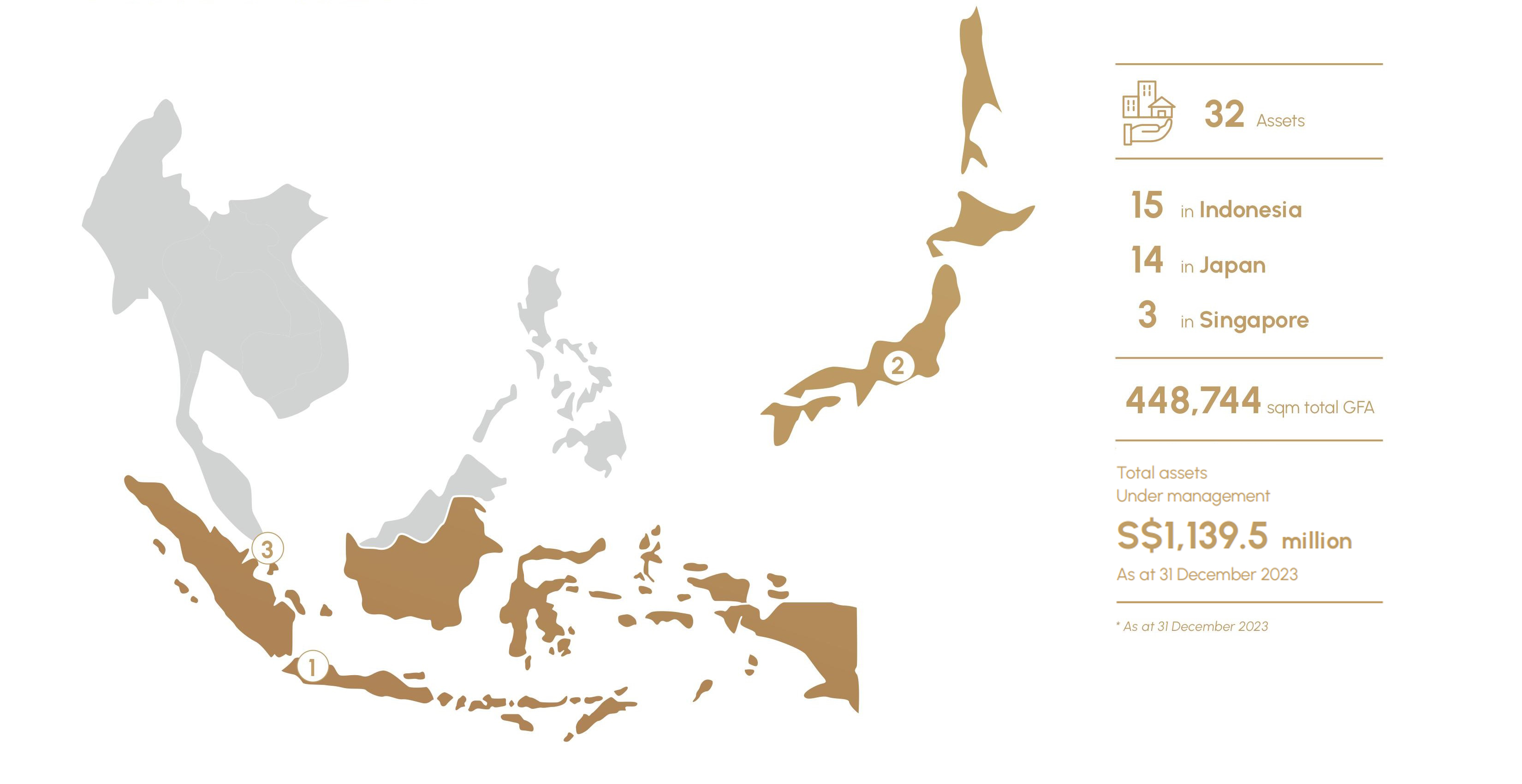

First REIT currently has a diversified portfolio of 32 highquality properties with stable cash flows and long lease terms in Indonesia, Japan and Singapore, which includes 11 hospitals in Indonesia, 14 nursing homes in Japan and three nursing homes in Singapore. First REIT also holds two integrated hospitals and malls, one integrated hospital and hotel, and one integrated hotel and country club in Indonesia.

First REIT’s portfolio of hospitals in Indonesia are strategically located within large catchment areas of potential patients, with each hospital being a “Centre of Excellence” or having an area of specialty. These Indonesian hospitals are operated by PT Siloam International Hospitals Tbk, a subsidiary of PT Lippo Karawaci Tbk and Indonesia’s leading private hospital network.

Other assets in Indonesia include the Imperial Aryaduta Hotel & Country Club and Hotel Aryaduta Manado, operated by The Aryaduta Hotel & Resort Group, as well as Lippo Plaza Kupang and Lippo Plaza Buton, managed by PT Lippo Malls Indonesia.

In 2022, First REIT successfully acquired 14 nursing homes in Japan, of which 12 of the nursing homes were acquired from OUEH. The 14 nursing homes in Japan are freehold assets with a combined gross floor area of approximately 103,234 square metres and 1,655 rooms, which are 100% masterleased to tenants who are well-established and experienced independent local nursing home operators.

First REIT’s other properties include well-run nursing homes in Singapore staffed by well-qualified, dedicated and experienced healthcare professionals.